How Paying Cash for Your Prescriptions Can Cost Less Than Your Copay

Have you ever asked your pharmacist what the cash-price is for your medication?

Probably not, but you should!

Most of our patients are shocked when they learn how much they can save by paying cash for their medications, rather than using the traditional route of applying their insurance and paying what they felt was a ‘small copay’.

What does it mean to pay cash for your prescriptions?

Paying cash for your prescriptions means that you are paying for your medications without using any insurance. The cost associated with this price includes the cost for the pharmacy to acquire the medication at a wholesaler, pharmacy dispensing fees, and an arbitrary mark-up for the pharmacy to make money. That mark-up is usually pharmacy dependent.

Why is the cash-price different than the insurance-price?

General Assumption: One would think using insurance should always be less than paying cash.

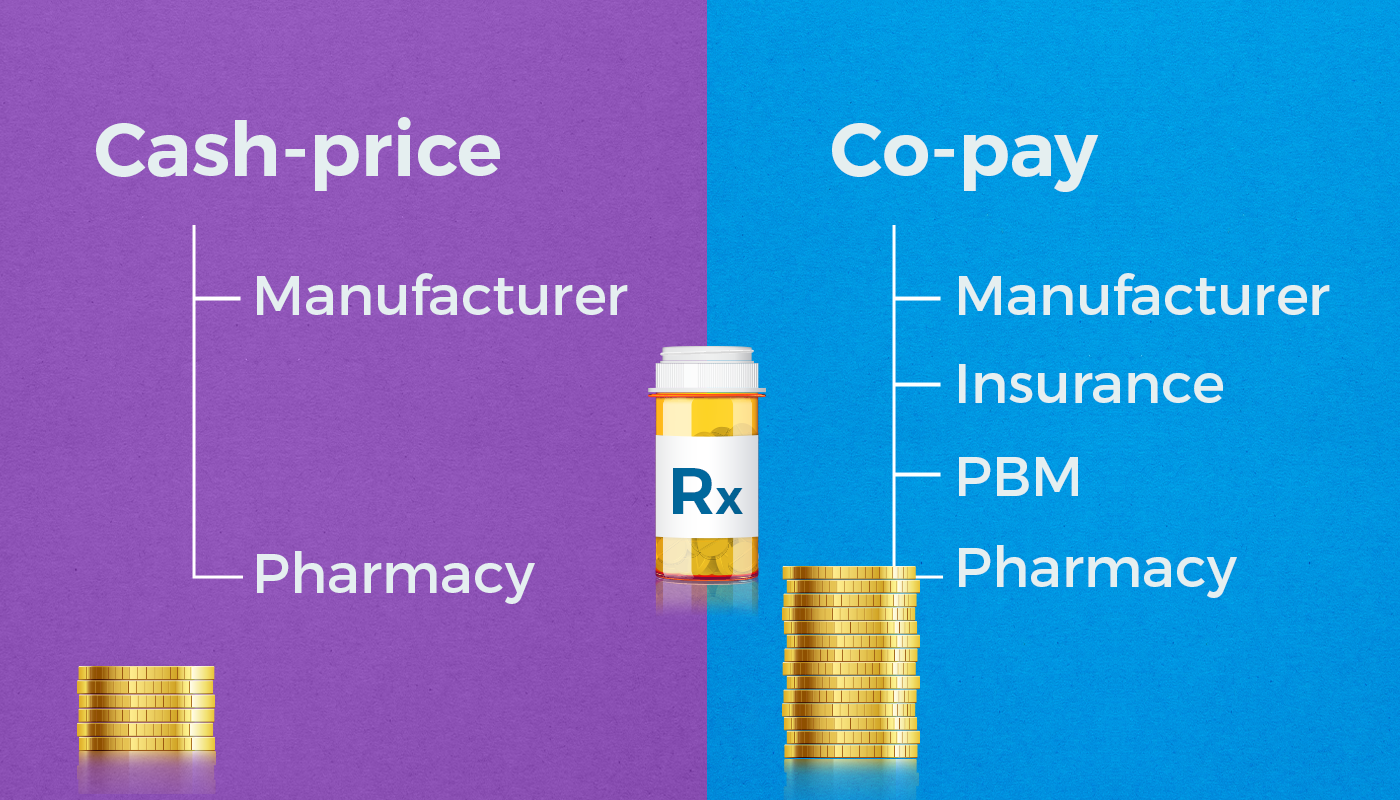

In reality, the cash-price and insurance-price are two separate things.

The insurance price, the price you pay for medications using your insurance at the pharmacy is decided by your insurance company and the pharmacy benefit manger (PBM) they hired to negotiate a “better price” for you.

Reason for the price discrepancy: While we as a pharmacy can purchase the medication for next to nothing, your insurance company and their PBM may have negotiated a different price and then marked it up a bit to make some money for their services.

We as a pharmacy have to offer that price to you based on what they negotiated and decided on, even if we can offer it to you for less!

Why haven’t I heard about this better offer?

Gag clauses have prevented pharmacists from telling you about a better deal.

You may not have heard that paying cash can often be cheaper that using insurance, and that’s likely because of unethical laws that currently exist preventing pharmacists from telling you about a better deal.

There are gag clause contracts with pharmacies and PBMs that prevent pharmacists from telling patients about affordable alternatives.

Some good news though, on October 10, 2018, Bill S.2553, Know the Lower Price Act was instated which allows pharmacists to inform patients under Medicare or Medicare Advantages plans of lower-price cash options.

While many laws still need to be changed to prevent these unethical practices, this new bill is a great step in the right direction to provide price transparency for patients.

How can it be more affordable to pay for prescriptions without insurance?

Paying for your prescriptions with insurance can cost more because it requires more steps to get your medications through the supply chain.

Built into these overcomplicated negotiations are administrative fees as well as unethical pricing strategies, termed spread pricing, which can profusely inflate the cost of medications.

These PBM and insurance company middlemen have been getting away with this unethical practice for decades and ultimately costing both employers and patients hundreds of millions more for the cost of generic medications.

In recent years, some states have introduced new laws to fight high drug prices and restrict practices that are costing taxpayers hundreds of millions every year.

Paying the cash price for your prescription means you can bypass the additional fees and middlemen which cause price inflation when you pay with insurance.

Don’t assume your insurance is saving you money

$10 per month is the national average copay for generic medications.

The Assumption: The assumption we all make is that our insurance copay is a good deal for us. With an average $10 copay, one would assume the medication costs a lot more than $10, especially since your insurance is also paying for some of it.

The Reality: The reality is that most generic medications cost next to nothing for pharmacies to buy. That $10 copay you are paying is extremely inflated and you and your insurance provider are overpaying for your medications. In fact, using your insurance may be costing you more.

Real Life Example—How paying with insurance costs you more

Many of our customers are often shocked to learn that paying cash is often less expensive than using insurance.

Here’s a real-life example:

Janice has a prescription for rosuvastatin (generic Crestor®) and wants to find the best savings for her medication. When Janice uses her insurance, she pays a copay of $10.00 a month. She assumes this is a good deal for her because the price she sees at the pharmacy, the price the PBM “negotiated” for her is $80 a month and Janice’s insurance covers $70 of the prescription giving her an 87.5% savings.

If Janice had asked for the cash price, she would be shocked to learn that her same rosuvastatin prescription is available at the cash price for less than her $10 copay.

At Marley Drug, Janice could get rosuvastatin (generic Crestor®) for $6.17 per month with a 6-month supply (38% less than a $10 copay) or $5.83 per month with a 12-month supply (41% less than a $10 copay.) That’s because it’s on a list of over 100 generic medications that we offer on Marley Drug's Wholesale Price List.

An important point not to be overlooked; Janice’s insurance plan is also paying a lot of money for this medication—$70/month! That’s an additional $840/year of healthcare costs on top of the extra $50 Janice is paying compared to our price.

What may seem like a low copay that is beneficial for patients is actually riddled with hidden fees by unethical middlemen. This ultimately drives up the cost of healthcare and increases the costs you and/or your employer pay for your health plan.

Whether you have a high copay, or a high deductible, our savings programs at Marley Drug often save you money!

Save on your Prescriptions at Marley Drug by paying without insurance

Marley Drug has over 100 generic prescriptions available through our Wholesale Price List which means you can get your same generic prescriptions at an affordable price, including free shipping.

- $6.17 per month when you buy a 6-month supply—38% less than a $10 copay!

- $5.83 per month when you buy a 12-month supply—41% less than a $10 copay!

No added pharmacy fees—No copay—Free shipping right to your door

Call Sam, Julie or Juan in our U.S. Support Center at 800-810-7790—they would love to speak with you!