You might be paying more for your generic medications. Here’s why.

Generic medications offer safe and affordable alternatives to expensive branded medications at only a fraction of the cost. In the U.S., 90% of medications prescribed are for generic versions. Despite the anticipated low cost of these medications, patients are still paying an average of $10 per month, even with insurance. So why are these prices still so high? Pharmacy Benefit Managers (PBMs) help insurance companies decide what medications should be covered, but charge a hidden fee for their services. This article covers in detail who the PBMs are and how you can avoid them (and save money) by paying cash for your medications.

With Insurance Patients Pay an Average Co-Pay of $10

What some people might not realize is that despite the significant investment you make into ensuring you have health insurance coverage, you may still be paying high deductibles or co-pays, even on things that you would think would be covered, like generic medications.

According to the KFF 2020 Employee Health Benefits Annual Survey, employees pay average co-pay of $10 per month for their generic medications.1

$10/month extra might not seem like much, but it adds up when you think about how much you are already paying for your insurance and how affordable generic medications generally are.

So why are you paying so much for your medications? It’s because of fees tacked on by the hidden middle-men in the chain.

You will be shocked to learn that cash prices can be less than copays on your prescription plans for many medications.

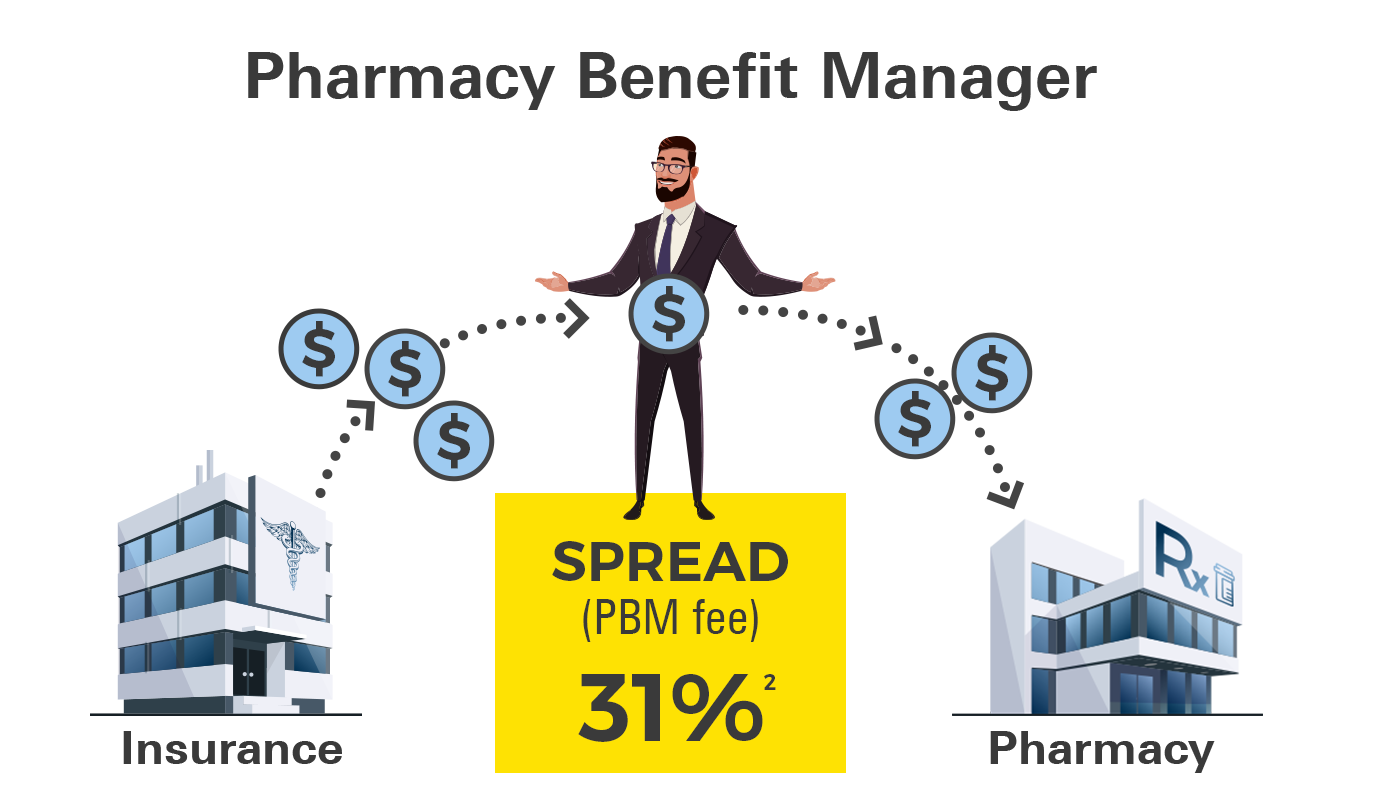

The PBMs: The Middle-Men of Prescription Health Benefit Plans

For prescription benefit plans, employers and insurance companies request assistance from organizations called pharmacy benefit managers (PBMs). The role of a PBM is to decide which medications, services, and procedures should be covered.

It is expected that they will negotiate affordable prices for medications as well as manage the appropriateness of certain medications that may be expensive, like branded medications. By providing these negotiations, the employer pays the PBM a fee for their service.

PBMs are an Unregulated Industry with Hidden Fees

Unfortunately, those fees are unregulated and are often hidden in a black box.

PBMs have positioned themselves as the middle-men between pharmacies, employers/patients, and the manufacturers of drugs. They control the entire game. While their intention is to help manage the affordability and appropriateness of medications, they frequently drive-up costs for employers and patients and reduce profitability for pharmacists and drug manufacturers, all while they fill their pockets with hidden fees.

To date, no federal agency or law is responsible for regulating the PBM industry. Likewise, at the state level, the majority of states do not regulate PBMs. The states that do regulate PBMs vary as to the aspect of PBM activities they regulate and to the extent they impose regulations.

PBMs Added on 31% Fees for Generic Medications in Ohio

An auditor’s report in 2018 found that in Ohio, PBMs added fees of 31% on generic medications.2 A 31% fee seem like a lot for negotiating a better price!

So, what exactly are these fees? They’re sometimes referred to as the “spread”—the difference between what an employer/insurance plan pays, and what the PBM pays the pharmacy to dispense the medication (i.e. their profit). The average spread, which in this example is State Medicaid Patients in Ohio, was $6.14 per month.2 Now keep in mind, that’s more than it costs to fill 50+ generic medications at Marley Drug if you’re paying cash and not using insurance.

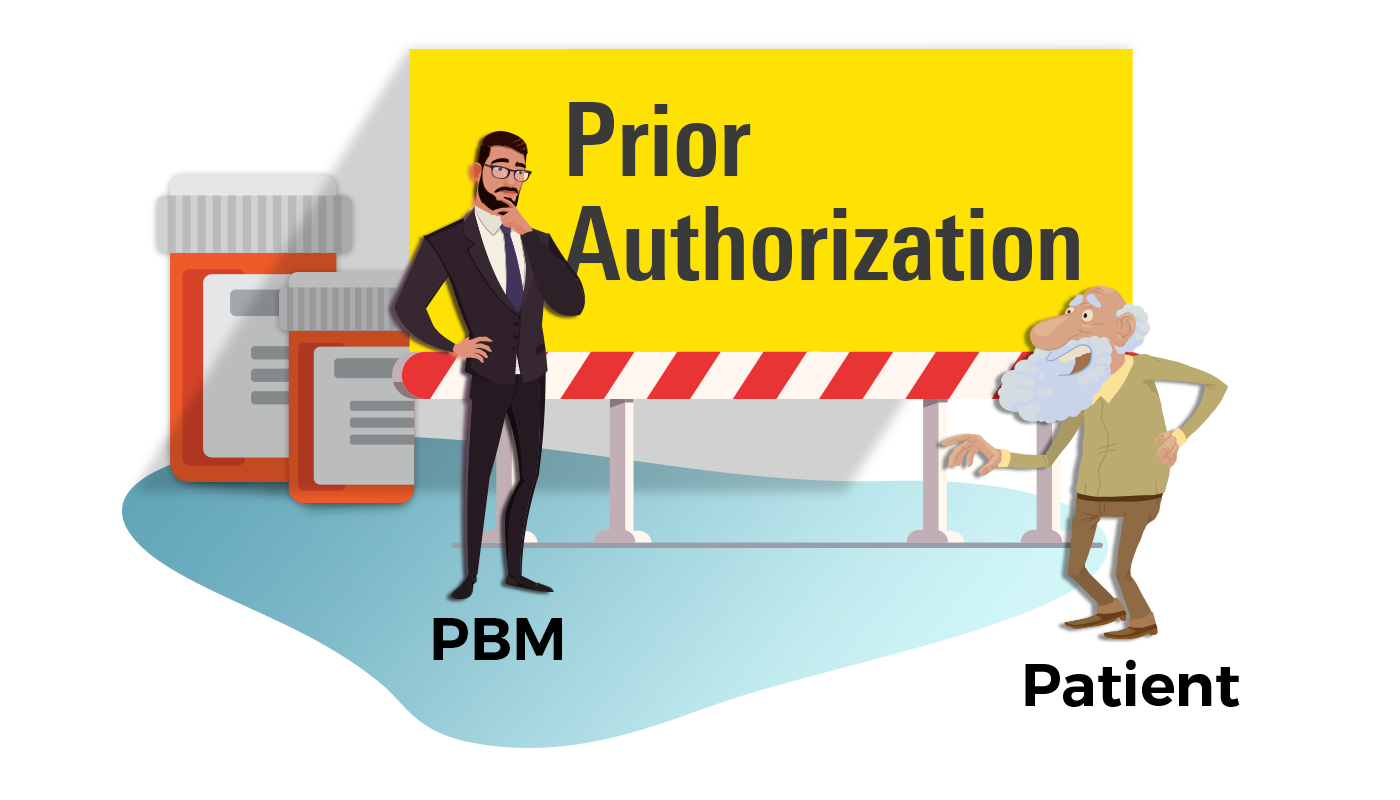

PBMs Make Access to Certain Medications Require Additional Approval

PBMs also create a system to help decide the appropriateness of medications, services, and procedures through a pre-approval process known as prior authorizations.

According to the America’s Health Insurance Plans group the primary goals of these prior authorization programs are to improve the quality, safety, appropriateness, and affordability of medications.3

A ecent survey of 1000 doctors actually showed that prior authorizations may be actually hurting patients, not helping them.

Prior authorizations also add on a lot of administration fees, which can further drive-up healthcare costs. In many instances prior authorizations can lead to medication changes, terms non-medical switching.

Our Solution: Pay Cash for your Generic Medications with Marley Drug and Cut out the Middle-Men

Marley Drug's Wholesale Price List was specifically designed to reduce the cost of expensive co-pays and deductibles.

Because our pricing model doesn’t involve any insurance program, we are cutting out the middle-men (the PBMs) who decide what drugs get covered and for how much. This means there are no added fees.

Our Wholesale Price List is very simple. If we can buy a 90-day supply of any generic drug for less than $12, it goes on our list of medications. We currently offer over 50 common medications for $70 a year. That’s less than $6 per month.

For medications above that price point there’s no need to worry. We price our medications based on what it costs us as a pharmacy to buy them. That way you can be assured you’re getting the best price. The only fee you pay here at Marley Drug is a dispensing fee, which you would pay at any other pharmacy in the U.S., but we promise you, we won’t artificially raise the price on medications just to make a quick buck.

Clopidogrel (generic Plavix®) |

||

| Width insurance | At Marley Drug | |

| Total cost | $720 | |

| Employer's cost | $600 | |

| Your cost | $120 | $70 |

An example of how you save with Marley Drug

When submitting an insurance claim, a one-year supply of generic Plavix (clopidogrel) 75 mg #360 costs around $720.00. That cost is ultimately paid for by both the employers and the employee. Typically, $600 would be paid for by the employer and the remaining would be paid for by the patient ($120). With Marley Drug, a one-year supply of the same drug reduces the overall cost substantially. We charge only $70 for a year supply of clopidogrel. That’s an overall savings of $650 total for just one medication.

References:

- 2020 KFF Employer Health Benefit Survey available at: https://www.kff.org/health-costs/report/2020-employer-health-benefits-survey

- Press Release: Ohio’s Auditor of State. Pharmacy Benefit Managers Take Fees of $31% on Generic Drugs Worth $208M in One-Year Period. August 16, 2018 available at https://ohioauditor.gov/news/pressreleases/Details/5042.

- AHIP Key Results of Industry Survey on Prior Authorization available at: http://www.ahip.org/wp-content/uploads/Prior-Authorization-Survey-Results.pdf

- 2020 AMA prior authorization (PA) physician survey available at: https://www.ama-assn.org/system/files/2021-04/prior-authorization-survey.pdf