Why the U.S. Pharma Industry Needs to be Transformed

What is the Pharmaceutical Supply Chain?

The pharmaceutical supply chain is the process of how drugs are created, distributed, priced, packaged, and sold. It’s heavily regulated to ensure all pharmaceutical products produced are safe to use and that there is a reliable stock available for the public.

Heavily regulated industries are susceptible to flaws, and unfortunately these flaws have become the status quo in the pharmaceutical industry.

While one would assume a supply chain would be designed to keep costs as low as possible so that you can afford your medications, this isn’t necessarily the case in the United States.

The pharmaceutical supply chain adopted additional middlemen in the chain many years ago called pharmacy benefit managers (PBMs). PBMs are middlemen negotiators who decide the price of medications (for a fee); this has led to increased medication costs and unethical practices in recent years.

How the Traditional Supply Chain Process Works

- Drugs made by manufacturers

- Pharmacy orders product from wholesaler and stocks on shelves

- Patients purchase drugs from pharmacy, get them delivered, or picks it up from the store

3 Ways the Traditional Supply Chain Increases Prices

1. Unethical Fees

Insurance providers pay PBMs to negotiate better prices for their medications. What many insurance providers don’t realize is that there are hidden fees built into this model, on top of the administrative fees they are already paying for this service.

As an example, when a patient fills a prescription at a pharmacy the PBM is responsible for paying the insurance companies portion of the medication. The PBM is later reimbursed by the insurance plan for the medication, however, the PBM often charges the insurance company more then they paid the pharmacy.

That difference is referred to as spread pricing, and that money goes straight into the PBMs pockets.

In Ohio, spread pricing inflated the cost of generic medications by 31%, or $6/month per medication and was found to be costing taxpayers $208 million dollars in 2018.1

Several states have adopted new laws and restrictions that makes PBMs pass on the same fees and discounts from the pharmacy to the insurance provider. This is called pass-through pricing and was recently adopted in Ohio. Taxpayers are expected to save $150 to $200 million a year with this change!

2. Inflated Pricing Strategies

The average wholesale price (AWP) has been around for over four decades now. It was used to determine pricing and reimbursement of prescription medications for third party groups like government and private payers.

Today, AWP doesn’t really mean anything. It’s a profusely inflated number given to a pharmaceutical product. It’s nowhere close to the price a patient would pay at a pharmacy.

Generally speaking, most insurance providers pay 20% of AWP. The insurer may not know AWP is a highly inflated number and likely thinks that the PBM they are paying is getting them a really good discount.

In reality, a pharmacy pays a fraction of the cost of AWP at the wholesaler. As an example, atorvastatin 20 mg costs a pharmacy $0.032/pill to buy, buts its AWP is $5.49/pill.

This difference leaves a lot of wiggle-room for PBMs to tack on additional fees before telling the insurance company how much they should pay for medications.

3. Unnecessary Steps in the Supply Chain

90% of medications prescribed in the U.S. are for generic medications. Generic medications are very inexpensive to produce, and there’s enough competition in the market to keep those prices low. As a result, there’s really no need for PBMs to be involved in negotiating discounts for generic medication. All it does is tack on additional fees that are ultimately paid for by insurance plans or patients and inflate our healthcare costs.

This process has remained status quo as it generates money for the middlemen and has not been challenged.

Real Life Example

The Traditional Supply Chain for Atorvastatin 20 mg

Atorvastatin 20mg has an AWP of $5.49/pill. Health plans typically pay 20% of AWP, which is $1.10/pill.

Pharmacies can purchase atorvastatin 20 mg from a wholesaler for $0.032/pill, or $0.96 for a month supply. Pharmacies also charge a dispensing fee. The national average dispensing fee is $0.35/pill.

Now remember, the PBMs ultimately decide the price of medications at the pharmacy. They use a complicated calculation to determine this price and this algorithm is usually proprietary to each PBM.

In this example, the PBM has decided that the pharmacy will be reimbursed $0.25/pill for atorvastatin 20 mg and that the patient will pay a co-pay of $10/month. Note that $10 is the national average co-pay for a generic prescription.

The pharmacy will profit $0.22/pill for this sale, and the PBM who was paid $1.10/pill by the insurance plan will profit a whopping $0.85/pill.

In this example the pharmacy is being underpaid, and the patient and plan sponsor are overpaying for the medication.

This pricing model is not fair for the pharmacy, the patient, or the plan sponsor.

According to a recent analysis by Kaiser Health News, the price of medications when using health insurance can add costs of up to $30 per prescription.Marley Drug: Removing the Middlemen

You can remove these middlemen fees by paying for your medications without insurance.

Many of our customers are often shocked to learn that paying cash is often less expensive than using insurance.

Whether you have a high co-pay or a high deductible, our programs often create BIG SAVINGS for our customers.

Advantages of not having to pay via insurance:

- PBMs can’t get involved

- No insurance headaches or pre-approval required

- No administrative fees or spread pricing fees added on to your medication prices

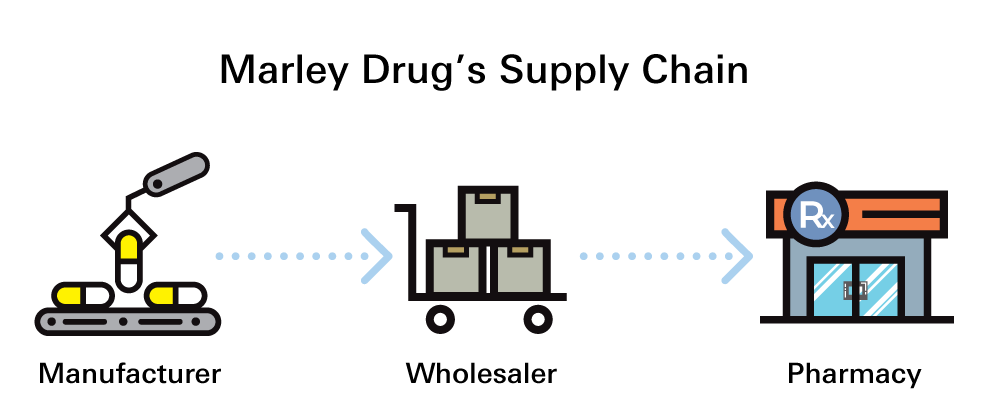

Marley Drug's supply chain process to get your prescriptions:

- Manufacturer

- Wholesaler

- Pharmacy

By streamlining the supply chain process, we are able to reduce your costs and provide you with affordable medications. There are no middlemen, meaning there are no PBM fees and no insurance headaches. Just a flat, transparent price!

We price our drugs based on what it costs us to buy them from our wholesalers.

How Challenging the Status Quo will Save Taxpayers Billions

In 2019, 977,402 Medicare Part D beneficiaries took ezetimibe, also known as generic Zetia®. That year Medicare Part D plans paid an average of $270 per patient for ezetimibe, resulting in a total cost of $264 million.

Now if they were to use Marley Drug’s pricing model, and cut out the middlemen, they could have saved $200 per person or $195 million.2 How?

It’s simple. Ezetimibe is on the Marley Drug Wholesale Price List of Marley Drug. This means we offer it for $37 for a 6-month supply, or $70 for a full year supply. This includes free shipping.

Marley Drug Offers Affordable Medications without Insurance

At Marley Drug, we offer over 100 generic medications through our Marley Drug Wholesale Price List.

With a valid prescription and without the need for insurance you can access all of these medications for just $37 for a 6-month supply, or $70 for a 12-month supply. That’s just ~$6 a month!

Plus, we will ship it right to your door. No additional costs!

Call 800-810-7790 to see how you can save on your generic prescriptions with our Wholesale Price List.